FAQs

Commonly asked questions

What is DeOrderBook?

DeOrderBook can best be described as a yield enhancer DEX, where users can earn while they simply hold their favourite tokens, place limit orders, or take part in simplified optionality.

What is DeOrderBook looking to achieve?

The goal of DeOrderBook is to abstract from complex financial engineering while allowing users to maximise their potential earnings from exposure to their favourite tokens.

The protocol's mission is to become a one-stop ecosystem that actively incentivizes greater user participation and greater precision in investment strategy.

How does DeOrderBook work?

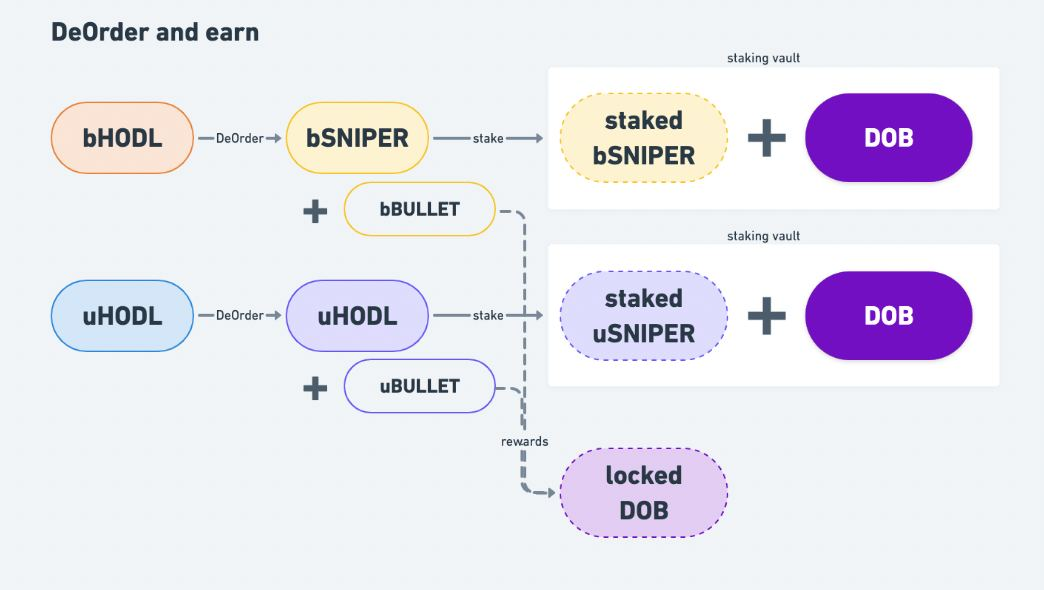

On DeOrderBook, there are 4 main tokens that users would be interacting with: $DOB, the native token of the platform, HODL tokens, SNIPER tokens and BULLET tokens.

In a nutshell, DeOrders can be used to turn HODL tokens into SNIPER tokens, through using strike and expiry. SNIPER tokens will then be automatically staked into the relevant pool (with matching strike and expiry) to earn $DOB rewards continually until the maturity date is reached.

Meanwhile, DeOrders also generate BULLET tokens, but BULLET tokens are sent as rewards to those who have locked their $DOB. A fixed number of $DOB per day will be shared by all stakers within the pool, in proportion with their staking size.

To get started, users must first use their supported currencies (currently $wBTCand $USDC) to mint the associated HODL tokens (bHODL and uHODL). Minting is done at a 1:1 ratio with zero associated fees, besides gas.

Once a user has their HODL tokens in hand, they can choose to either to

a) stake HODL directly onto DeOrderBook

b) use HODL to mint SNIPER tokens.

Direct staking will allow for a basic APY to be earned, but this would typically be less than the potential APYs to be earned from using SNIPER tokens to perform the DeOrder action.

DeOrder involves minting HODL into SNIPER: choosing a price at which to mint, a stated amount, and an expiry date. The expiry date would determine the APY.

Throughout, users are rewarded with $DOB tokens, the native token of the platform that also functions as a governance token. $DOB tokens can be locked to receive a portion of BULLET rewards and rebates, with BULLET tokens able to be traded freely among users on the BULLET Marketplace. $DOB tokens may also be sold on PancakeSwap via the $DOB liquidity pool.

Why use DeOrderBook?

DeOrderBook sets itself aside from the competition by being the first DeFi protocol that brings value from outside liquidity without relying on internal competition. No longer do users have to simply HODL their most beloved cryptocurrencies while losing out on profiting from the exciting volatility of the markets.

DeOrderBook offers every user an absolutely secure way to participate in derivatives markets without needing deep financial engineering expertise and without risking their long-held bags.

What fees are associated with using DeOrderBook?

The DeOrderBook protocol aims to incentivize greater user adoption, charging no fees for minting HODL tokens from supported cryptos.

A 0.2% fee is collected by the protocol in the following 4 actions:

unlocking: combining SNIPER and BULLET tokens to early unwind calls and unlock HODL tokens

exercising: combining BULLET and HODL tokens to exercise calls and/or puts that are most likely in-the-money

collecting: using SNIPER tokens to collect HODL tokens whether or not calls/puts are or are not exercised

redeeming: rolling back HODL tokens to supported cryptos

Why join DeOrderBook's soft launch?

During DeOrderBook's soft launch, all functions will be available for new users to try out the protocol. DeOrderBook's core vision is to create an exclusive community centred around a gamified conceptionalization of the 'Trade to Earn' concept.

Soft launch participants will be added to a pool where they may be randomly selected for further interviews by the team. There are a slew of perks planned for those joining our beta tests: such as airdrops, priority whitelisting for NFT minting on mainnet and unique Discord roles... just to name a few! Stay tuned for more news soon.